- #Reviews of best free budgeting software update

- #Reviews of best free budgeting software registration

- #Reviews of best free budgeting software android

- #Reviews of best free budgeting software software

#Reviews of best free budgeting software software

What to look for in budgeting software Customizable budget categories You can also set a monthly savings goal as a percentage of your income, analyze your spending trends, and keep tabs on your total income, expenses, and remaining budget.

As you enter each transaction, you can add context by choosing from location-based list of merchants, tagging who you were with, and attaching a photo or the receipt.

#Reviews of best free budgeting software android

Consider setting up savings goals, if possible.įrom there, you can explore the rest of the app’s features to see what it has to offer-look for handy tools like bill alerts and subscription tracking, and advice for making and sticking to a budget.The Wally+ Android app makes it easy to record expenses as they’re incurred. You may be able to set transaction categories, or the app may do that for you if so, check the categories to make sure they’re accurate. You’ll typically be asked to provide your income, and to sync up your bank accounts, credit cards, debit cards, loans, and other financial accounts.

#Reviews of best free budgeting software registration

Depending on the app, registration may only require an email address.Īfter logging in, you may find step-by-step instructions to get started by adding your financial information. Start by going to the company website or downloading the app, and then create a new account. Signing up for budgeting apps is usually quite easy.

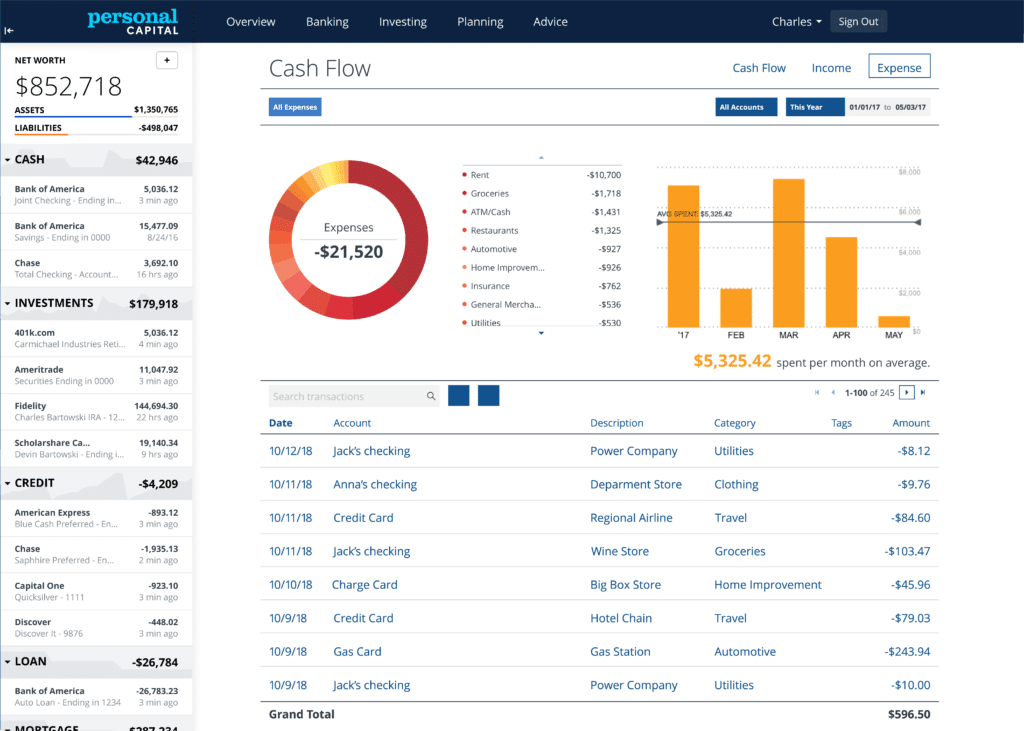

Extra features: Some apps include extra perks like a free credit score or investment tracking.Budget sharing: If you share finances with a partner or roommates, can you make use of the same budget to help you stay on the same page?.Mobile app: Is there a mobile app along with an online dashboard? Is it easy to navigate and use, and does it include all the features of the online dashboard?.Multiple budgets: Are you limited to a single budget, or can you create multiple budgets for different purposes?.Bill payment tracker/reminders: Having all of your bills in one place, with reminders when payments are due, will help you avoid monthly surprises.Goal setting: Can you set savings goals, like having a certain amount in retirement and emergency funds, and track your progress along the way?.It’s hard to know if you’re making progress without this kind of information. Reports can help you compare spending from month to month and across categories. Charts/reports: Most budgeting apps give you some kind of overview of your income and expenses, letting you visualize the big picture.Budget alerts: It’s nice to get a notice before you go over budget for the month.Can the app tell the difference automatically? If not, can you categorize transactions yourself? This is one of the most useful aspects of budgeting apps. Automatic transaction categorizing: “Groceries” are purchases from the grocery store “Dining out” are purchases at restaurants.

#Reviews of best free budgeting software update

Many apps generate reports to show how your finances change over time. They can automatically sync up with all of your bank accounts and payment cards, categorize your transactions, and give you a bird’s-eye view of what you buy and how much you spend each month. But even wealthy people could spend and save more wisely with the help of a budget.īudgeting apps take a lot of the work out of making and maintaining a budget.

If you’re living paycheck to paycheck or struggling with debt, your need for more control over your finances might be all too clear. A budget can give you a clear picture of how much money you have coming in and going out. If you make and spend money, it’s likely that you could benefit from a budget of some kind. Guide to Choosing the Best Budgeting App Determine Your Need for a Budgeting App Free basic version PocketGuard Pro: $7.99 per monthīudgeting tool is free 0.89% for investment accounts under $1,000,000

0 kommentar(er)

0 kommentar(er)